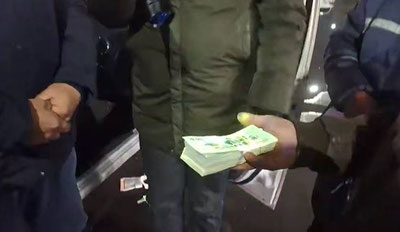

During the ongoing tax inspection activities, this citizen has realized 357 types of goods and services worth 123.2 billion UZS to 4 legal entities in March and April of this current year here.

These purchases by legal entities were carried out with the intention of creating artificially accounted VAT amounts and legalizing the incoming documents of goods.

Which requirements of tax legislation have been violated in this case?

Firstly, if the income of a self-employed individual exceeds 100 million UZS, they pay a turnover tax (TOT) at a rate of 4 percent like an individual entrepreneur.

Therefore, an additional TOT is calculated for the said self-employed individual.

Secondly, if the income of a self-employed individual exceeds 1 billion UZS, they are mandatorily considered as VAT payers and must be registered in the tax authorities. Thus, VAT and income tax are additionally calculated from their income exceeding 1 billion UZS.

Thirdly, incomes obtained outside the labor activity of self-employed individuals are taxed in accordance with the procedure established in the Tax Code.

When such cases are detected, analytical and verification materials are submitted to law enforcement agencies for legal assessment purposes.

In conclusion, to avoid serious legal and financial consequences from the committed violations, self-employed citizens must conduct their activities in accordance with legal documents.