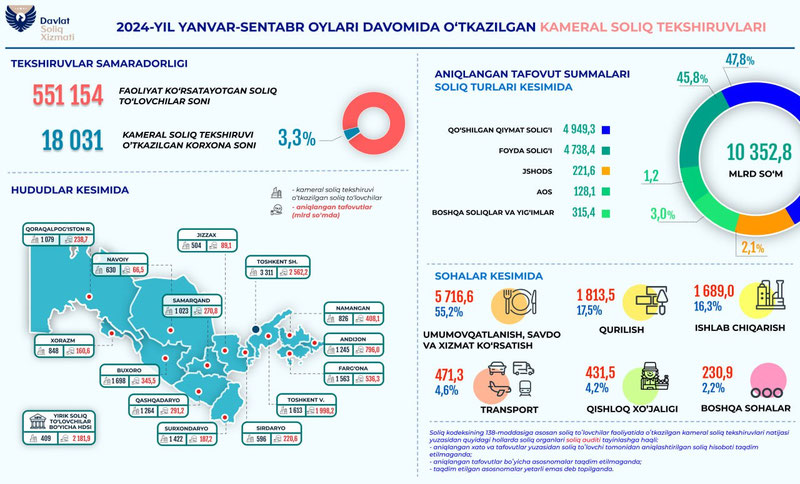

Throughout January to September 2024, camera tax inspections were conducted on 18,000 taxpayers. This represents 3.3% of the entrepreneurial entities operating across the republic (551.1 thousand). The Press Service of the Tax Committee reported this to darakchi.uz.

As a result of these inspections, differences amounting to 10,352.8 billion UZS were identified, and notices about these discrepancies were sent to taxpayers.

The differences were mainly identified in the following types of taxes:

- VAT – 4,949.3 billion UZS;

- Profit tax – 4,738.4 billion UZS;

- Social infrastructure development tax – 221.6 billion UZS;

- Fixed tax – 128.1 billion UZS;

- Other taxes and fees – 315.4 billion UZS.

The sectors with the largest discrepancies identified were:

- General catering, trade, and services – 5,716.6 billion UZS;

- Construction – 1,813.5 billion UZS;

- Manufacturing – 1,689 billion UZS;

- Transport - 471.3 billion UZS.

- Agriculture - 431.5 billion UZS;

- Other sectors - 230.9 billion UZS.