When importing an iPhone 17 for personal needs into Uzbekistan, if the device's value exceeds the established norm, a customs payment of 30 percent will be levied on the excess amount.

According to the reminder from the Customs Committee, the value norms for goods imported into the republic by individuals on a non-payment basis (i.e., not for trade or business purposes) are set as follows:

for air transport — $1000 USD,

for railway and river transport — $500 USD,

for automobile and pedestrian routes — $300 USD.

If the customs value of the iPhone 17 exceeds these norms, a single customs payment of 30 percent on the part exceeding the norm, as well as a registration fee of 25 percent of the base calculation amount (103,000 soum), will be levied.

Information about the device's price must be confirmed by a sales receipt, invoice, or other documents. Otherwise, the customs authority independently determines the value of the device — for this purpose, prices from Apple's official website or other reliable alternative sources are used as a basis.

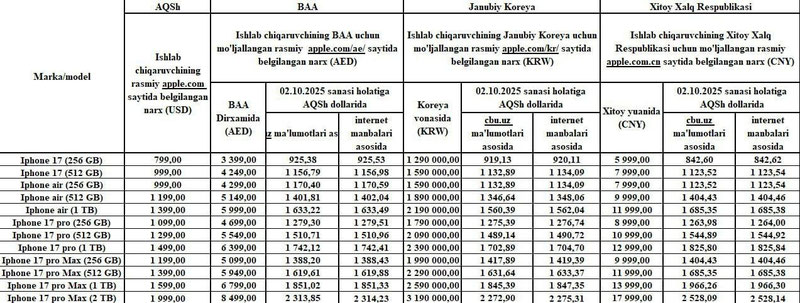

The Committee specifically added that for iPhone 17s imported from the USA, UAE, South Korea, and China, the customs value is determined based precisely on the official prices in those countries.